PHH Mortgage Corporation: Difference between revisions

m Citing sources |

m References and included images |

||

| Line 1: | Line 1: | ||

{{DISPLAYTITLE:PHH Mortgage Corporation (Onity Mortgage)}} | |||

{{Incomplete|Issue 1=The consumer impact summary need source to back up the claims made. These may overlap with the settlements below but are needed nevertheless.}} | {{Incomplete|Issue 1=The consumer impact summary need source to back up the claims made. These may overlap with the settlements below but are needed nevertheless.}} | ||

{{InfoboxCompany | {{InfoboxCompany | ||

| Line 7: | Line 8: | ||

| Official Website =https://www.phhmortgage.com/ | | Official Website =https://www.phhmortgage.com/ | ||

| Logo =PHH-Mortgage.png | | Logo =PHH-Mortgage.png | ||

}}PHH Mortgage Corporation is a subsidiary of Onity Group, Inc., a privately held mortgage servicer and lender based in Florida. As of June 10, 2024, Onity Mortgage has been established as a dba (doing business as) of PHH Mortgage.<ref>https://business.phhmortgage.com/BusinessPHH/media/BusinessPHH/Pdf/PHH_Onity-FAQs.pdf</ref> | }} | ||

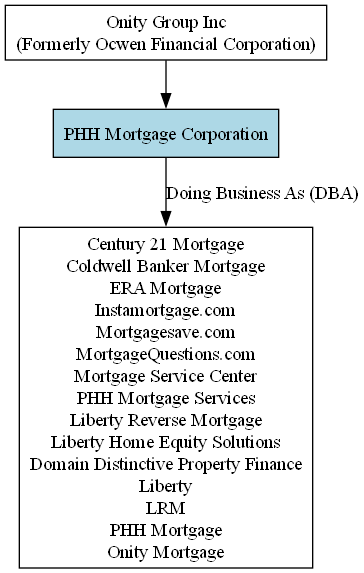

[[File:OnityGroupCompanyTree PHHMortgageCorporation V1.png|alt=Tree describing company relationships under the Onity Group, highlighting PHH Mortgage Corporation in light blue|none|thumb|579x579px|PHH Mortgage Corporation]] | |||

PHH Mortgage Corporation is a subsidiary of Onity Group, Inc., a privately held mortgage servicer and lender based in Florida. As of June 10, 2024, Onity Mortgage has been established as a dba (doing business as) of PHH Mortgage.<ref>https://business.phhmortgage.com/BusinessPHH/media/BusinessPHH/Pdf/PHH_Onity-FAQs.pdf</ref> | |||

==Consumer impact summary== | ==Consumer impact summary== | ||

| Line 15: | Line 18: | ||

==Incidents== | ==Incidents== | ||

===$6.25 Million Consumer Fraud Act Settlement (''2011'')=== | |||

In a settlement announced by Acting Attorney General John J. Hoffman,<ref>{{Cite web |last=Hoffman |first=John |date=4 Dec 2013 |title=Acting Attorney General Announces $6.25 Million Settlement Resolving Consumer Fraud Act Allegations Against PHH Mortgage |url=https://nj.gov/oag/newsreleases13/pr20131204a.html |access-date=7 Mar 2025 |website=The State of New Jersey Office of Attorney General}},</ref> New Jersey reached a $6.25 million agreement with PHH Mortgage Corporation to resolve allegations that the company misled financially struggling homeowners seeking loan modifications or assistance to avoid foreclosure. | |||

===$45 Million Multi-State Settlement (''2018'')=== | ===$45 Million Multi-State Settlement (''2018'')=== | ||

| Line 32: | Line 38: | ||

*Lacking a structured process for document preparation, execution, and notarization in foreclosure cases. | *Lacking a structured process for document preparation, execution, and notarization in foreclosure cases. | ||

=== | === Mortgage Service Center === | ||

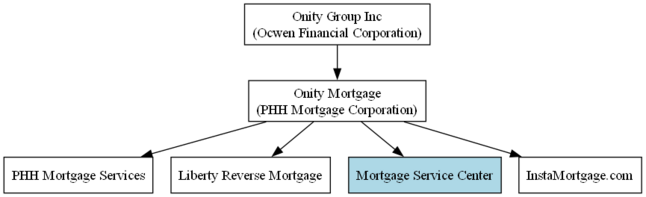

[[File:OnityGroupCompanyTree MortgageServiceCenter V1.png|alt=Onity Group Company Tree with Mortgage Service Center highlighted in light blue, to show relationship to the parent companies|none|thumb|646x646px|'''Onity Group Company Tree''']] | |||

Mortgage Service Center is a registered DBA of PHH Mortgage Corporation<ref>https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=b9c14d71-c21d-ea11-918b-00155d01b4fc</ref><ref>https://extranet.dfi.in.gov/ConsumerCredit/EntityDetails/2881</ref><ref>https://licensing.coag.gov/s/license-report/a1mcs000001xAl2AAE/sup4000219005</ref>, and engages in direct marketing by utilizing publicly available county records, including property details such as closing dates, loan amounts, lender names, mortgagor names, and addresses, to contact new homeowners with mortgage-related offers. | |||

By referencing details related to a homeowner's recent mortgage, Mortgage Service Center aims to establish credibility and engage potential customers. | |||

==References== | ==References== | ||

| Line 39: | Line 48: | ||

[[Category:{{PAGENAME}}]] | [[Category:{{PAGENAME}}]] | ||

[[Category:Mortgage lenders]] | |||

[[Category:Direct Marketing]] | |||

Revision as of 00:22, 8 March 2025

⚠️ Article status notice: This article has been marked as incomplete

This article needs additional work for its sourcing and verifiability to meet the wiki's Content Guidelines and be in line with our Mission Statement for comprehensive coverage of consumer protection issues. In particular:

- The consumer impact summary need source to back up the claims made. These may overlap with the settlements below but are needed nevertheless.

This notice will be removed once the issue/s highlighted above have been addressed and sufficient documentation has been added to establish the systemic nature of these issues. Once you believe the article is ready to have its notice removed, please visit the Moderator's noticeboard, or the discord and post to the #appeals channel.

Learn more ▼

| Basic information | |

|---|---|

| Founded | 2008 |

| Legal structure | Subsidiary |

| Industry | Mortgages |

| Official website | https://www.phhmortgage.com/ |

PHH Mortgage Corporation is a subsidiary of Onity Group, Inc., a privately held mortgage servicer and lender based in Florida. As of June 10, 2024, Onity Mortgage has been established as a dba (doing business as) of PHH Mortgage.[1]

Consumer impact summary

PHH Mortgage Corporation, a non-bank residential mortgage servicer, has faced multiple allegations related to improper loan servicing practices, impacting borrowers across the United States. The company has been accused of failing to properly apply borrower payments, charging unauthorized fees, and mishandling loan modification requests. In some cases, PHH provided misleading information to homeowners facing foreclosure, and in others, it failed to maintain accurate records or oversee third-party vendors involved in servicing and foreclosure processes[2].

These practices have led to financial hardship for many homeowners, with some experiencing delays or miscommunications that resulted in foreclosures or loss of modification opportunities[3]. In response to these allegations, PHH has reached settlements, including restitution for affected borrowers and commitments to adopt improved servicing standards[4]. Despite these actions, the company’s practices have raised concerns about transparency, consumer protection, and the treatment of financially struggling homeowners.

Incidents

$6.25 Million Consumer Fraud Act Settlement (2011)

In a settlement announced by Acting Attorney General John J. Hoffman,[5] New Jersey reached a $6.25 million agreement with PHH Mortgage Corporation to resolve allegations that the company misled financially struggling homeowners seeking loan modifications or assistance to avoid foreclosure.

$45 Million Multi-State Settlement (2018)

In a multi-state settlement announced by Attorney General Christopher S. Porrino,[2] New Jersey reached a $45 million agreement with PHH Mortgage Corporation to resolve allegations of improper mortgage loan servicing. The settlement, which includes more than 45 states and the District of Columbia, addresses claims that PHH Mortgage failed to properly service loans over a four-year period.

Between January 1, 2009, and December 31, 2012, PHH Mortgage Corporation was accused of engaging in improper mortgage servicing practices, including: Alleged improper mortgage servicing practices, including:

- Misapplying borrower payments and maintaining inaccurate account statements.

- Charging unauthorized fees for default-related services.

- Providing conflicting and misleading information to borrowers facing foreclosure.

- Failing to respond adequately to borrower complaints and loan modification requests.

- Mishandling loss mitigation applications and documentation.

- Lacking proper loan servicing records and foreclosure documentation.

- Inadequately supervising third-party vendors involved in servicing and foreclosure.

- Submitting foreclosure documents with inaccurate or incomplete information.

- Using improperly executed affidavits in foreclosure proceedings.

- Lacking a structured process for document preparation, execution, and notarization in foreclosure cases.

Mortgage Service Center

Mortgage Service Center is a registered DBA of PHH Mortgage Corporation[6][7][8], and engages in direct marketing by utilizing publicly available county records, including property details such as closing dates, loan amounts, lender names, mortgagor names, and addresses, to contact new homeowners with mortgage-related offers.

By referencing details related to a homeowner's recent mortgage, Mortgage Service Center aims to establish credibility and engage potential customers.

References

- ↑ https://business.phhmortgage.com/BusinessPHH/media/BusinessPHH/Pdf/PHH_Onity-FAQs.pdf

- ↑ 2.0 2.1 Porrino, Christopher (3 Jan 2018). "Attorney General Porrino Announces $45 Million Multi-State Settlement with PHH Mortgage Corporation". Retrieved 7 Mar 2025.,

- ↑ https://www.nj.gov/oag/newsreleases18/PHH_Complaint-for-filing-v1.pdf

- ↑ https://www.nj.gov/oag/newsreleases18/PHH_Consent-Judgment.pdf

- ↑ Hoffman, John (4 Dec 2013). "Acting Attorney General Announces $6.25 Million Settlement Resolving Consumer Fraud Act Allegations Against PHH Mortgage". The State of New Jersey Office of Attorney General. Retrieved 7 Mar 2025.,

- ↑ https://mblsportal.sos.state.mn.us/Business/SearchDetails?filingGuid=b9c14d71-c21d-ea11-918b-00155d01b4fc

- ↑ https://extranet.dfi.in.gov/ConsumerCredit/EntityDetails/2881

- ↑ https://licensing.coag.gov/s/license-report/a1mcs000001xAl2AAE/sup4000219005